Building Automated Deal Flow Pipelines with AI and n8n

Intelligence DispatchesFebruary 14, 202612 min

Building Automated Deal Flow Pipelines with AI and n8n

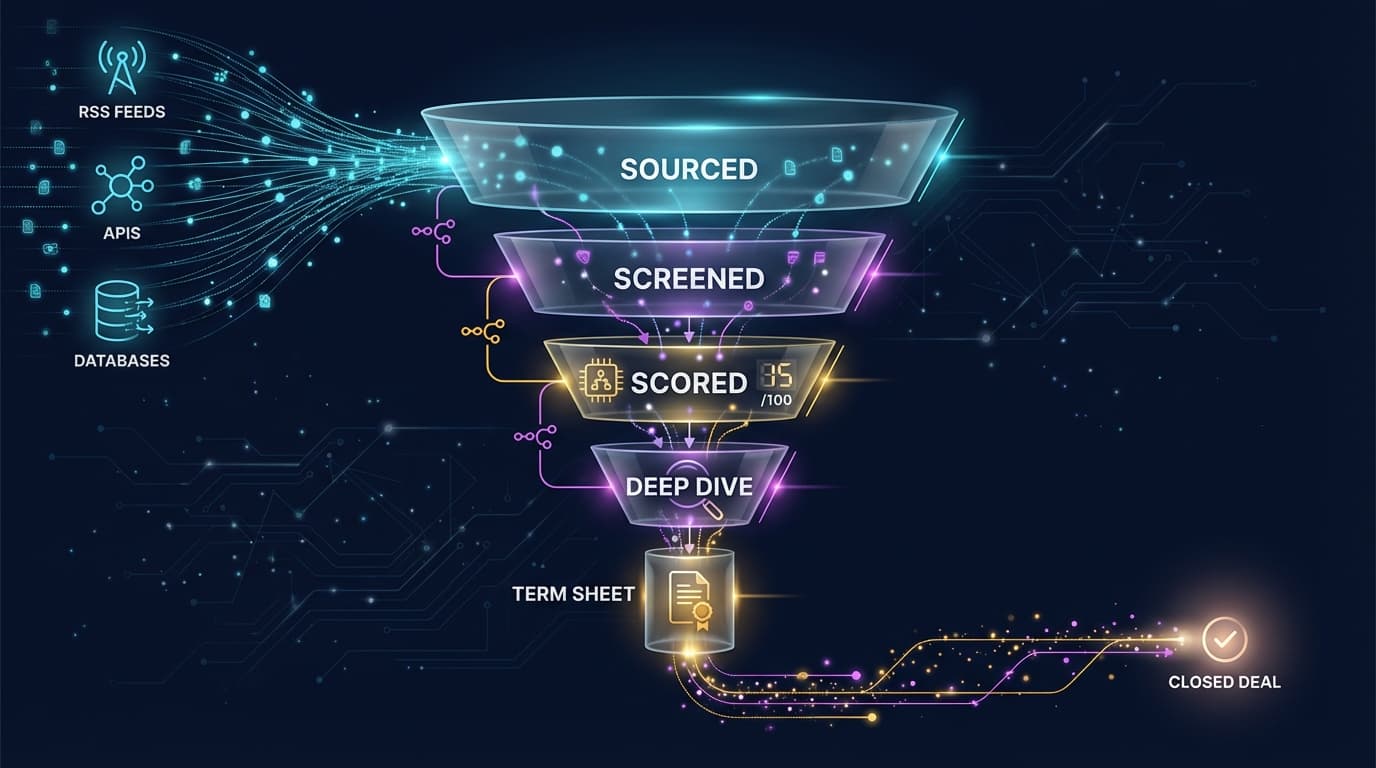

How to build an automated deal sourcing, screening, and scoring pipeline using n8n workflows, Claude agents, and persistent memory. From RSS feeds to scored deal cards.

Venture capital firms see thousands of deals per year. Angels and solo investors see hundreds. The bottleneck isn't finding opportunities — it's systematically evaluating them without burning all your time on screening.

n8n, now valued at $2.5B after a $180M Series C, is the workflow automation platform that makes AI deal flow pipelines practical. Combined with Claude agents for intelligent scoring and persistent memory for context, you can build a system that runs continuously and gets smarter over time.

Here's the architecture.

Pipeline Architecture

Data Sources → Ingestion → Screening → Scoring → Pipeline → Digest

↓

Human Review

Each stage is a separate workflow component that can be tested and tuned independently:

| Stage | Tool | What It Does |

|---|---|---|

| Ingestion | n8n triggers (RSS, webhook, cron) | Monitors 10-30 data sources for new deals |

| Deduplication | n8n + memory | Checks if we've already seen this company |

| Screening | Claude agent + criteria | Quick pass/fail against investment thesis |

| Scoring | Claude agent + scoring framework | Quantitative 0-100 score across 7 dimensions |

| Pipeline | n8n + Notion/Airtable | Stage tracking from Sourced through Close |

| Digest | Claude agent + template | Weekly summary to team (Slack/email) |

Stage 1: Data Source Ingestion

The first n8n workflow monitors your deal sources:

RSS Feeds (15-second setup each):

- TechCrunch Funding section

- Crunchbase funding alerts

- VentureBeat deal announcements

- Sector-specific blogs (e.g., AI, SaaS, fintech)

API Connections (requires credentials):

- Crunchbase API: New funding rounds in target sectors

- PitchBook: Deal alerts matching your criteria

- AngelList: New syndicates in your focus areas

- ProductHunt: Top launches in target categories

Scheduled Scraping (Playwright/Puppeteer):

- Y Combinator batch pages

- SEC EDGAR for S-1 filings

- Specific accelerator demo day pages

Each source pipes deals into a standardized format:

{

"company": "Acme AI",

"sector": "Enterprise SaaS",

"stage": "Series A",

"raised": "$12M",

"investors": ["Sequoia", "a16z"],

"source": "crunchbase",

"sourceDate": "2026-02-14",

"url": "https://...",

"description": "AI-powered customer support platform"

}

Stage 2: Deduplication and Enrichment

Before scoring, the pipeline checks memory:

- Already seen? Skip if processed in the last 90 days

- Related to an existing deal? Flag as potential follow-on

- In a tracked sector? Add sector context from prior research

The enrichment step pulls additional data:

- Funding history (all rounds, total raised)

- Team LinkedIn profiles (founders, key hires)

- Product metrics (if publicly available)

- Competitor context (from memory)

Stage 3: Quick Screen Against Criteria

A Claude agent runs a rapid pass/fail against your investment criteria:

## My Investment Criteria

- Stage: Seed to Series B

- Sector: AI/ML, Enterprise SaaS, Developer Tools

- Geography: US, Europe

- Minimum: Product launched, some revenue signal

- Red flags: Solo non-technical founder, pivoted 3+ times

Deals that clearly fail criteria get tagged PASS with reason. Deals that clearly match get tagged SCREEN. Ambiguous deals get tagged REVIEW for human triage.

This step filters out 60-70% of inbound deals immediately.

Stage 4: Quantitative Scoring

Deals that pass screening get scored across 7 weighted dimensions:

| Criterion | Weight | Scoring Guide |

|---|---|---|

| Market Size (TAM) | 15% | >$10B = 10, $1-10B = 7, <$1B = 4 |

| Growth Rate | 15% | >50% YoY = 10, 20-50% = 7, <20% = 4 |

| Team Strength | 20% | Serial founders = 10, experienced = 7, first-time = 4 |

| Product-Market Fit | 15% | Revenue + retention = 10, revenue only = 7, pre-revenue = 4 |

| Competitive Moat | 15% | Strong (network/IP) = 10, moderate = 7, weak = 4 |

| Deal Terms | 10% | Below market = 10, at market = 7, above = 4 |

| Strategic Fit | 10% | Core thesis = 10, adjacent = 7, outside = 4 |

The Claude agent researches each dimension and produces a score card:

Score: 73/100 — RECOMMEND FIRST LOOK

Market Size: 8/10 (15%) = 1.2 — $15B TAM, growing

Growth Rate: 7/10 (15%) = 1.05 — ~35% YoY

Team: 9/10 (20%) = 1.8 — Serial founder, strong CTO

PMF: 6/10 (15%) = 0.9 — Revenue but retention unclear

Moat: 7/10 (15%) = 1.05 — Data advantage, switching costs

Terms: 7/10 (10%) = 0.7 — At market for stage

Fit: 8/10 (10%) = 0.8 — Core thesis alignment

Thresholds:

- Score >= 70: Recommend Deep Dive

- Score 50-69: Conditional — needs specific data points

- Score < 50: Pass with documented reason

Stage 5: Pipeline Management

Scored deals enter a pipeline with stage tracking:

Sourced → Screened → First Look → Deep Dive → IC Review → Term Sheet → Closed

Each stage transition requires:

- Screened → First Look: Score >= 50, human confirms

- First Look → Deep Dive: Score >= 65, DD Lead initiates

- Deep Dive → IC Review: DD report complete, score >= 70

- IC Review → Term Sheet: Investment committee approval

- Term Sheet → Closed: Legal and final terms

The pipeline syncs to Notion (for visual kanban) or Airtable (for structured data), providing the team with a real-time view.

Stage 6: Weekly Digest

Every Monday morning, a Claude agent compiles the week's pipeline activity:

# Deal Flow Digest: Week of Feb 10, 2026

## Pipeline Summary

| Stage | Count | Change |

| ---------- | ----- | ------ |

| Sourced | 47 | +23 |

| Screened | 12 | +8 |

| First Look | 3 | +2 |

| Deep Dive | 1 | +0 |

## Top Scored Deals This Week

1. **Acme AI** — Score: 78/100 — AI customer support, Series A, $12M

2. **DataForge** — Score: 73/100 — Developer data tools, Seed, $4M

3. **NeuralOps** — Score: 71/100 — AI operations platform, Series A, $8M

## Deals Advanced

- Acme AI: Screened → First Look (strong PMF signals)

## Deals Passed

- FooBar Inc: Passed at Screening (solo non-technical founder)

- BazCorp: Passed at Scoring (TAM < $500M)

This gets delivered via Slack, email (Resend), or both.

Why This Compounds Over Time

The persistent memory layer is what transforms this from a workflow into an intelligence system:

- Sector context grows: Every deal analyzed adds to your sector knowledge. By deal #50, the agent has deep context on competitive dynamics, typical metrics, and market positioning.

- Scoring calibrates: Track which scored deals you actually invested in and how they performed. Use this to tune scoring weights.

- Pattern recognition: After 6 months, the system identifies patterns — "Companies in sector X with metric Y above Z tend to score well" — that inform future screening.

Getting Started

Minimum viable pipeline (2-3 hours to set up):

- 5 RSS feeds in n8n (TechCrunch, Crunchbase, 3 sector blogs)

- Claude agent for quick screen against your criteria

- Notion database for pipeline tracking

- Weekly digest to your email

Full system (use IACOS):

- Clone investor-intelligence repo

- Configure IACOS with your investment criteria

- Connect n8n workflows for automated ingestion

- Set up MCP servers for persistent memory and web research

- See the IACOS Setup Guide for step-by-step instructions

The infrastructure investment pays for itself after the first month. One missed deal that your pipeline would have caught easily justifies the setup time.

For the complete system architecture, visit AI Investment Intelligence in the Research Hub, or explore the Investor Intelligence tools on frankx.ai.

Read on FrankX.AI — AI Architecture, Music & Creator Intelligence

Weekly Intelligence

Stay in the intelligence loop

Join 1,000+ creators and architects receiving weekly field notes on AI systems, production patterns, and builder strategy.

No spam. Unsubscribe anytime.