IACOS: How to Configure Claude Code as Your Investment Research OS

Creator SystemsFebruary 14, 202614 min

IACOS: How to Configure Claude Code as Your Investment Research OS

Turn Claude Code into a dedicated investment research platform with custom skills, agent profiles, MCP servers, and visual intelligence. The complete IACOS setup guide.

I built ACOS (Adaptive Creator OS) to configure Claude Code as an intelligent creative development environment. After shipping it across 500+ sessions, I realized the same architecture could transform investment research.

IACOS is the result: a complete configuration system that turns Claude Code into a multi-tool investment research platform. Not a prompt pack. Not a chatbot wrapper. A full operating system for investment analysis with skills, agents, persistent memory, and visual intelligence.

Here's how it works and how to set it up.

What IACOS Actually Is

IACOS is a folder of configuration files that plug into Claude Code:

iacos/

├── CLAUDE.md # The brain — instructions, methodology, quality gates

├── skills/ # 10 specialized research skills

│ ├── due-diligence.md # Full company analysis framework

│ ├── market-research.md # TAM/SAM/SOM and industry mapping

│ ├── financial-analysis.md # Revenue modeling, valuations, comps

│ ├── competitive-landscape.md # Competitor mapping and moat analysis

│ ├── earnings-analysis.md # Earnings call extraction and comparison

│ ├── thesis-builder.md # Investment thesis structuring

│ ├── memo-writer.md # Investment memo generation

│ ├── visual-intelligence.md # AI image generation for reports

│ ├── deal-flow-automation.md # Deal sourcing and scoring

│ └── source-validator.md # Cross-reference and trust scoring

├── agents/ # 6 agent profiles with tool bindings

│ ├── research-analyst.md

│ ├── dd-lead.md

│ ├── financial-modeler.md

│ ├── visual-strategist.md

│ ├── portfolio-analyst.md

│ └── deal-flow-manager.md

├── .coworker/

│ └── config.json # Team collaboration config

└── SETUP.md # Step-by-step setup guide

When you open Claude Code in a workspace with these files, it becomes an investment research system that knows how to:

- Run structured due diligence following a 10-section framework

- Score deals quantitatively against your investment criteria

- Generate AI-powered market maps and competitive visuals

- Validate every claim against a 5-level source hierarchy

- Persist research context across sessions via memory MCP

- Chain skills together for complex multi-step workflows

The Multi-Tool Architecture

IACOS works across four Claude interfaces, each serving a different research mode:

| Interface | Best For | Setup |

|---|---|---|

| Claude Code | Deep research, batch analysis, file generation | Full IACOS directory |

| Claude Desktop | Quick lookups, pitch deck analysis | Paste CLAUDE.md as project instructions |

| Coworker | Team DD, collaborative reports | Import .coworker/config.json |

| Claude Chat | Thesis brainstorming, ad-hoc questions | Reference methodology manually |

The power is in orchestration. A typical workflow:

- Claude Desktop: Upload a pitch deck for 5-minute screening

- Claude Code: If promising, run full DD with all skills and MCP servers

- Nano Banana: Generate market map and competitive matrix visuals

- Coworker: Share DD report with team for collaborative review

Skills: The Core Research Capabilities

Each skill is a markdown file that defines a specific research methodology. Skills are composable — they chain together for complex workflows.

Skill Composition Patterns

Full Due Diligence Pipeline:

market-research → competitive-landscape → financial-analysis

→ thesis-builder → memo-writer → visual-intelligence

Earnings Season Workflow:

earnings-analysis → financial-analysis → thesis-builder (update)

Deal Screening:

deal-flow-automation → source-validator → due-diligence (if scored ≥65)

How Skills Trigger

Natural language triggers activate the right skill:

| You Say | Skill Activated | What Happens |

|---|---|---|

| "run DD on Stripe" | due-diligence | 10-section DD report with scoring |

| "research the AI infra market" | market-research | TAM/SAM/SOM analysis with sources |

| "analyze NVDA earnings" | earnings-analysis | QoQ comparison, guidance tracking |

| "score deal Anthropic" | deal-flow-automation | 7-dimension quantitative scoring |

| "create market map for fintech" | visual-intelligence | Nano Banana generates dark-theme visual |

| "validate that $50B TAM claim" | source-validator | Cross-reference against L1-L3 sources |

Agent Profiles: Scoped Roles

Each agent profile defines what tools, skills, and MCP servers an agent can access. This matters for two reasons:

- Focus: A Financial Modeler doesn't need web search — it works with validated data from the Research Analyst

- Safety: The Visual Strategist generates images but doesn't make investment recommendations

The 6 agents:

| Agent | Core Skills | Key Tool Access |

|---|---|---|

| Research Analyst | market-research, source-validator | Web search, Playwright, memory |

| DD Lead | due-diligence, memo-writer | All tools, orchestrates other agents |

| Financial Modeler | financial-analysis, earnings-analysis | Read/write, bash, memory |

| Visual Strategist | visual-intelligence | Nano Banana MCP, memory |

| Portfolio Analyst | portfolio-review, risk-assessment | Read/write, memory |

| Deal Flow Manager | deal-flow-automation, thesis-builder | Web search, memory, Playwright |

Visual Intelligence: AI-Generated Investment Visuals

This is the feature that doesn't exist in any competing product. IACOS generates professional investment visuals using the Nano Banana MCP (Gemini image generation).

Every visual follows brand standards: dark navy backgrounds, glowing neon accents, glass morphism aesthetics. Never clip art. Never white backgrounds. Institutional quality.

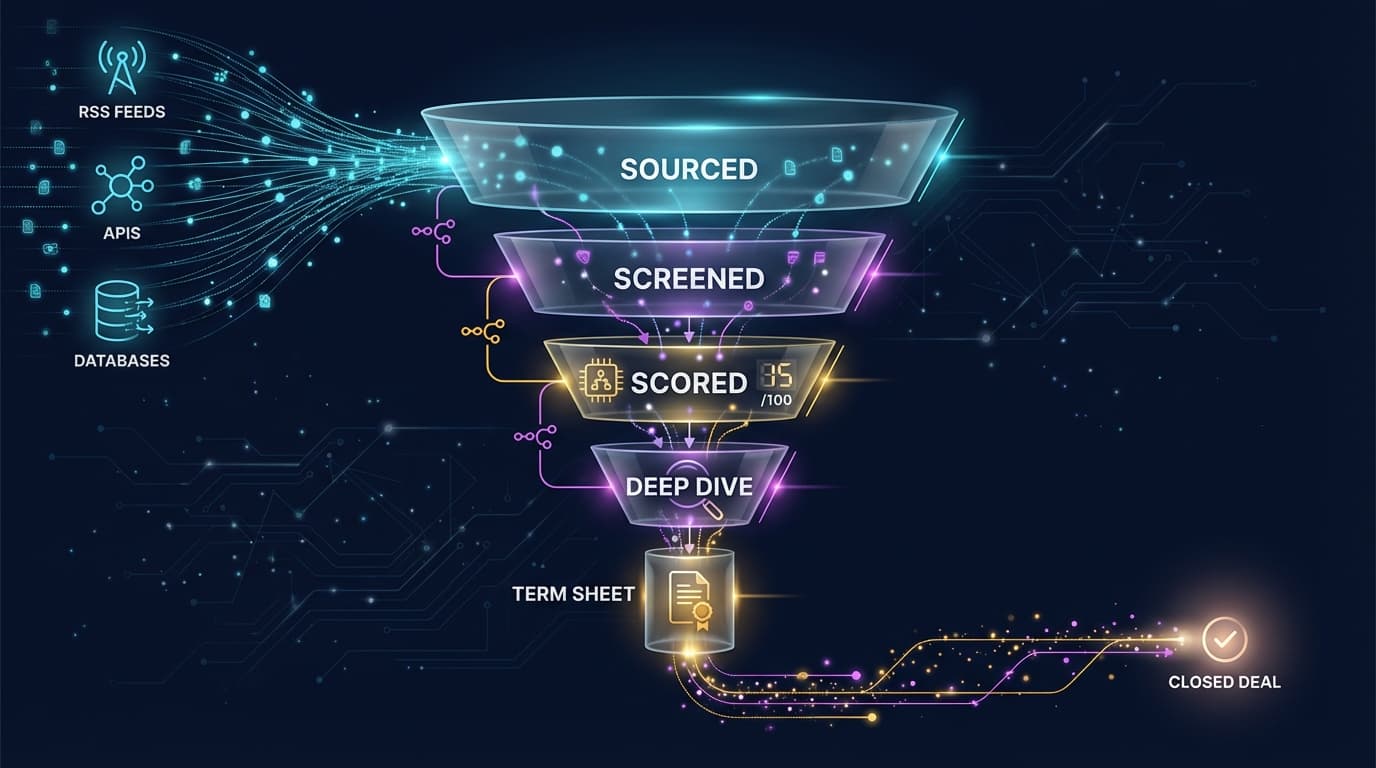

What you can generate:

- Market maps: Sector landscape with companies positioned by market share and growth

- Competitive matrices: Side-by-side comparison grids

- Risk heat maps: Severity grids with color-coded risk factors

- Deal flow funnels: Pipeline stage visualization with deal counts

- Report covers: Professional cover pages for DD reports and memos

- Portfolio dashboards: Holdings overview with allocation visuals

These get saved to research/visuals/ with full metadata (prompt used, data source, generation date) for reproducibility.

Source Validation: The Quality Gate

The most important feature in IACOS isn't the flashiest — it's the source validation system that runs passively during all research.

Every claim gets tagged with a trust level:

| Level | Source Type | Treatment |

|---|---|---|

| L1 | SEC filings, 10-K, 10-Q | Highest trust, presented as fact |

| L2 | Bloomberg, PitchBook | High trust, presented as fact |

| L3 | McKinsey, Gartner | Medium-high, note methodology |

| L4 | WSJ, TechCrunch | Medium, qualify as "reported by" |

| L5 | Twitter, Reddit | Low, signal only, never presented as fact |

When the source validator runs a deep check on a document, it produces a validation report:

Validation Score: 82% — Strong

Claims Verified: 14 of 17

Issues:

- Revenue claim ($50M ARR): Single source (L4), needs L1-L2 verification

- Market size ($15B): Sourced from 2024 Gartner report, check for update

- Team claim (ex-Google): Verified via LinkedIn (L3)

This prevents the biggest risk in AI-assisted research: presenting AI-generated analysis as if it were verified fact.

MCP Server Stack

IACOS recommends four MCP servers:

Memory (Required)

claude mcp add memory -- npx -y @anthropic/memory-mcp

Research context persists across sessions. Your findings compound over time. When you research a sector, all previous research on related companies is available as context.

Sequential Thinking (Required)

claude mcp add sequential-thinking -- npx -y @anthropic/sequential-thinking-mcp

Breaks complex analysis into structured steps. Essential for 10-section DD reports and multi-criteria scoring.

Playwright (Recommended)

claude mcp add playwright -- npx -y @anthropic/playwright-mcp

Direct web scraping for SEC EDGAR filings, earnings transcripts, company websites, and financial data platforms.

Nano Banana (Recommended)

claude mcp add nanobanana -- npx -y @anthropic/nanobanana-mcp

AI image generation for market maps, competitive visuals, and report covers.

Setup in 5 Minutes

# Clone the repo

git clone https://github.com/frankxai/investor-intelligence.git

cd investor-intelligence/iacos

# Create your workspace

mkdir -p ~/investor-research/.claude/{skills,agents}

mkdir -p ~/investor-research/research/{dd-reports,market-analysis,earnings,memos,visuals}

mkdir -p ~/investor-research/data

# Copy IACOS

cp CLAUDE.md ~/investor-research/CLAUDE.md

cp skills/*.md ~/investor-research/.claude/skills/

cp agents/*.md ~/investor-research/.claude/agents/

# Install MCP servers

claude mcp add memory -- npx -y @anthropic/memory-mcp

claude mcp add sequential-thinking -- npx -y @anthropic/sequential-thinking-mcp

claude mcp add playwright -- npx -y @anthropic/playwright-mcp

claude mcp add nanobanana -- npx -y @anthropic/nanobanana-mcp

# Launch

cd ~/investor-research && claude

Then customize by editing CLAUDE.md to add your investment criteria, sector focus, and scoring preferences.

From ACOS to IACOS

IACOS inherits three architectural principles from ACOS that make it more than a collection of prompts:

1. Pattern Routing: Tasks are analyzed for intent and routed to the optimal skill + agent combination. "Analyze Stripe's competitive position" triggers the competitive-landscape skill via the Research Analyst agent, not a generic response.

2. Quality Gates: Every output passes through validation. DD reports can't be "complete" with missing sections. Claims can't be presented without sources. Low-confidence outputs trigger additional research suggestions.

3. Learning Integration: Research outcomes are tracked over time. Thesis accuracy can be validated against actual market performance. The system gets better as you use it.

Who This Is For

IACOS is designed for three user types:

VC/PE Analysts: Full DD pipeline, deal scoring, LP reporting automation. The complete stack replaces 2-3 point tools with a unified system.

Angel Investors: Systematic research process without a team. Consistent deal evaluation against your thesis. Weekly deal digests from automated monitoring.

Research Analysts: Institutional-quality output from a solo setup. Source validation prevents embarrassing errors. Visual intelligence makes reports presentation-ready.

Getting IACOS

IACOS is available at frankx.ai/investor as part of the Investor Intelligence product suite. The full system includes all skills, agent profiles, MCP configuration, and setup guides for Claude Code, Claude Desktop, and Coworker.

Explore the full AI Investment Intelligence research domain, or browse the Investor Hub for all available tools and templates.

Read on FrankX.AI — AI Architecture, Music & Creator Intelligence

Weekly Intelligence

Stay in the intelligence loop

Join 1,000+ creators and architects receiving weekly field notes on AI systems, production patterns, and builder strategy.

No spam. Unsubscribe anytime.