EU Inc Explained: The '28th Regime' That Could Finally Unify European Startups

Intelligence DispatchesJanuary 21, 20267 min read

EU Inc Explained: The '28th Regime' That Could Finally Unify European Startups

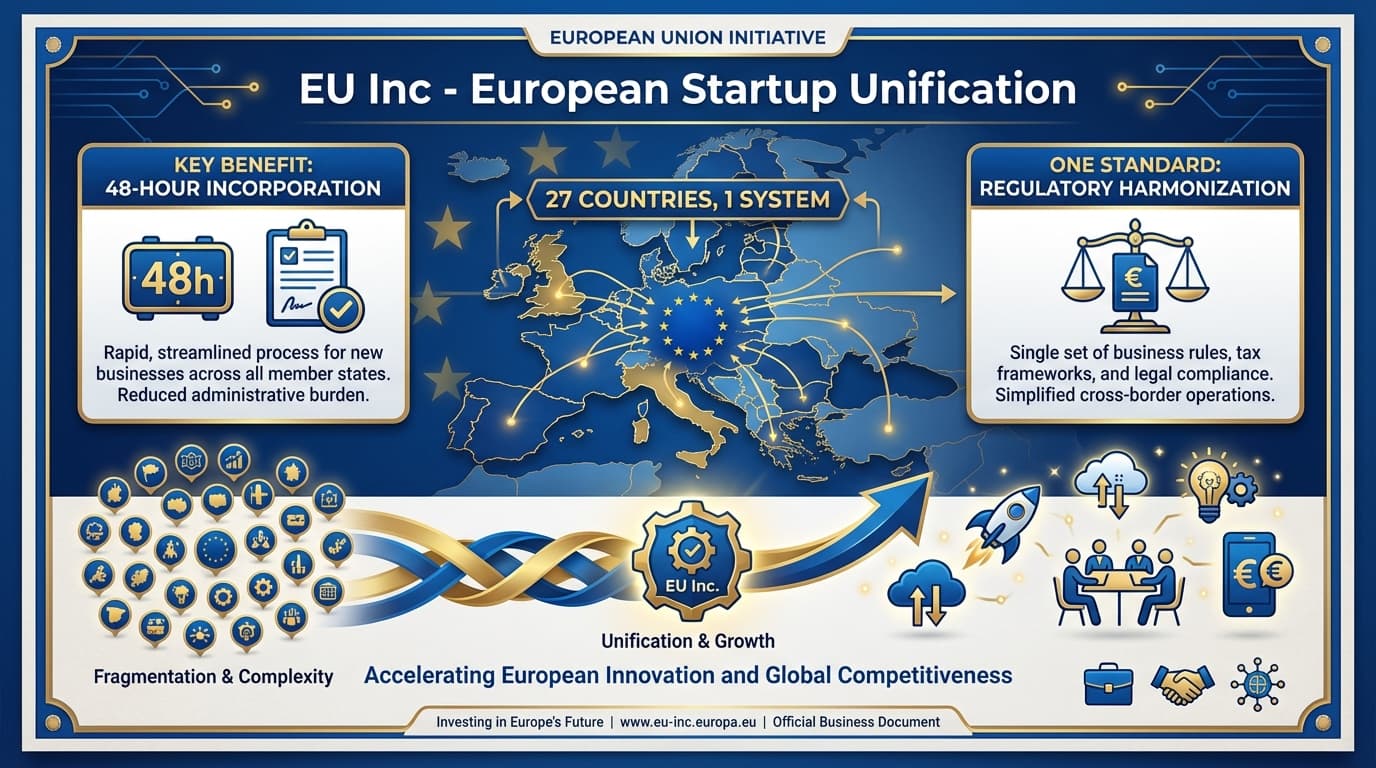

The European Commission just announced EU Inc - a pan-European company structure promising 48-hour incorporation across all member states. Here's what it means for founders, investors, and the European startup ecosystem.

🎯

Reading Goal

Understand what EU Inc means for European founders and whether it will actually change the startup landscape

TL;DR: On January 20, 2026, European Commission President Ursula von der Leyen announced EU Inc—a new "28th regime" allowing companies to incorporate across all EU member states under a single legal structure, with 48-hour online registration. It's designed for startups but available to all companies. Implementation likely in 2027.

What Just Happened

At Davos 2026, Ursula von der Leyen made an announcement European founders have been waiting decades for: EU Inc, a pan-European company structure that exists alongside—not replacing—national corporate forms.

The name comes from the concept of a "28th regime"—an optional EU-level framework that sits above the 27 member states' individual systems.

"One Europe. One Standard." — EU Inc proposal tagline

The Problem EU Inc Solves

Europe has a single market in theory. In practice, companies face:

- 27 different company laws

- 27 registration processes

- 27 capital requirements

- 27 administrative timelines

- 27 employment law frameworks

A startup in Estonia wanting to hire in France, raise from German investors, and sell to Italian customers must navigate four completely different legal systems.

Compare this to the United States, where a Delaware C-Corp can operate seamlessly across all 50 states.

EU Inc aims to be Europe's Delaware.

Key Features

1. Single Legal Structure

One company form recognized across all 27 member states. No need for subsidiaries, branches, or local entities in each country where you operate.

2. 48-Hour Online Incorporation

The proposal targets fully digital company formation in two days. Compare this to the current weeks-to-months timeline for cross-border operations.

3. Unified Rulebook

Standard governance, capital requirements, and administrative procedures. Founders learn one system, not 27.

4. Pan-European ESOP Framework

A unified employee share option scheme across Europe. Currently, stock option taxation and treatment varies wildly between countries—making it hard to compete with US startups for talent.

5. Anti-Double-Taxation Framework

The proposal includes tax provisions aimed at preventing companies from being taxed twice when operating across borders.

What's NOT Unified

Employment law remains under member state control. If you hire someone in France, French employment law applies—even with an EU Inc structure.

This is a significant limitation. Employment is often the biggest cross-border complexity for startups.

Who Benefits Most

Startup Founders

The primary target audience. EU Inc removes friction from:

- Scaling across borders: Hire, sell, and raise without legal complexity

- Investor relations: One cap table, one structure, familiar to global investors

- Talent competition: European ESOP framework helps compete with US offers

Investors

Standardization benefits investors through:

- Due diligence simplification: One legal structure to understand

- Portfolio consistency: Same governance across European investments

- Exit clarity: Standard structure for M&A and IPO

Scale-ups Going Global

Companies that have outgrown their home market can now expand across Europe without the legal overhead that currently makes US expansion more attractive.

Non-EU Companies Entering Europe

A single entry point to the European market, rather than picking one country and dealing with complexity in others.

The Reality Check

EU Inc is not law yet.

What was announced is a commitment to develop the framework. The actual regulation must be:

- Drafted by the European Commission

- Negotiated between Commission, Parliament, and Council

- Approved by both Parliament and member states

- Implemented with technical systems for registration

The 48-hour incorporation target is aspirational. Current estimates suggest 2027 as a realistic rollout.

And even then, member states may resist aspects that threaten national tax revenue or employment autonomy.

What This Signals

Even without immediate implementation, the announcement matters:

1. Political Will Exists

The Commission is publicly committed. The startup ecosystem has been lobbying for this for years—now it's on the agenda at the highest levels.

2. Competition Response

Europe is responding to US dominance in tech. The explicit framing is about competitiveness—keeping European startups in Europe rather than reincorporating in Delaware.

3. Regulatory Modernization

The 48-hour digital incorporation target signals broader ambitions for government digitalization.

Comparison: EU Inc vs. Current Options

| Feature | EU Inc (Proposed) | Estonian e-Residency | Delaware C-Corp |

|---|---|---|---|

| Incorporation time | 48 hours | 1-2 days | 24 hours |

| Recognized across | 27 EU states | 1 state + EU treaties | 50 US states |

| Online formation | Yes | Yes | Yes |

| ESOP framework | Unified EU | Estonian law | Standard US |

| Employment law | Local applies | Estonian | State varies |

What Founders Should Do Now

1. Don't Wait

EU Inc won't be available for 1-2 years minimum. If you're founding now, use existing structures. Estonian e-Residency remains a popular option for EU-wide operations.

2. Follow Development

The regulation will go through many drafts. Opportunities to influence exist through:

- EU Inc official proposal site

- National startup associations

- European Parliament consultations

3. Plan for Transition

If EU Inc delivers on promises, transitioning to the new structure may be valuable. Keep corporate structures simple and migration-friendly.

4. Consider US Structure

For truly global ambitions—especially with US investors—Delaware incorporation still offers advantages EU Inc won't match:

- US investor familiarity

- US court system

- NASDAQ/NYSE listing path

EU Inc solves European complexity, not global positioning.

Key Takeaways

-

EU Inc is real but not ready - The announcement is significant, but implementation is 1-2 years away at minimum

-

It's opt-in, not mandatory - National company forms continue to exist; EU Inc is an additional option

-

Employment stays national - The biggest cross-border complexity isn't fully addressed

-

Founders are the target - The design explicitly serves startups and scale-ups

-

The signal matters - Even pre-implementation, this indicates political will to reduce European fragmentation

Frequently Asked Questions

When will EU Inc be available?

Optimistically, 2027. The regulation must be drafted, negotiated, and approved before implementation can begin.

Will my existing company convert to EU Inc?

Conversion mechanisms will likely be included, but details aren't available yet. Design your current structure to be migration-friendly.

Does EU Inc replace my national company?

No. It's an optional "28th regime" that exists alongside national forms. You can choose EU Inc or continue with your national structure.

How does taxation work under EU Inc?

The proposal includes anti-double-taxation provisions, but specific tax treatment remains under development. Tax is often the most contentious aspect of EU harmonization.

Is EU Inc only for startups?

Startups are the primary target, but the structure will be available to any company. Large enterprises may find it useful for restructuring European operations.

What about the UK?

Post-Brexit, the UK is not part of EU Inc. Companies wanting both UK and EU operations will still need separate structures.

Resources

- EU Inc Official - Official information hub

- EU Inc Proposal - Community input on design

- Sifted Coverage - Detailed analysis

Sources: Medium, EU Inc Official, abZ Global, Sifted, The Next Web

Related Articles

- Enterprise Agent Roadmap — AI transformation strategy

- AGI 2026: Opportunities — Preparing for the future

- Intelligence Revolution 2025 — The landscape that brought us here

Read on FrankX.AI — AI Architecture, Music & Creator Intelligence

Weekly Intelligence

Stay in the intelligence loop

Join 1,000+ creators and architects receiving weekly field notes on AI systems, production patterns, and builder strategy.

No spam. Unsubscribe anytime.